7 Powerful Ideas - How To Fight Overwhelm In Retirement

7 Powerful Ideas - How To Fight Overwhelm In Retirement

Blog Article

When do you think you should begin preparing for your retired life? When you are a couple of months far from retirement? A couple of years? Now is the ideal response. Retirement preparation is a task every individual has towards themselves. And let me inform, the earlier you understand this and shake yourselves to do something about it the much better. For those who are currently on their way, give yourself a pat on the back. Being spontaneous is fun, however when it concerns serious phases in life such as retirement you have to get serious and take choices and make solid strategies.

Establishing a retirement strategy and conserving for your retirement might be several years away for you however, if you start early, particularly in your twenties and thirties and do that up until you retire in your fifties and sixties, you'll have a much more comfortable retirement than your female counterparts who didn't save anything and now are counting on the federal government to help them out.

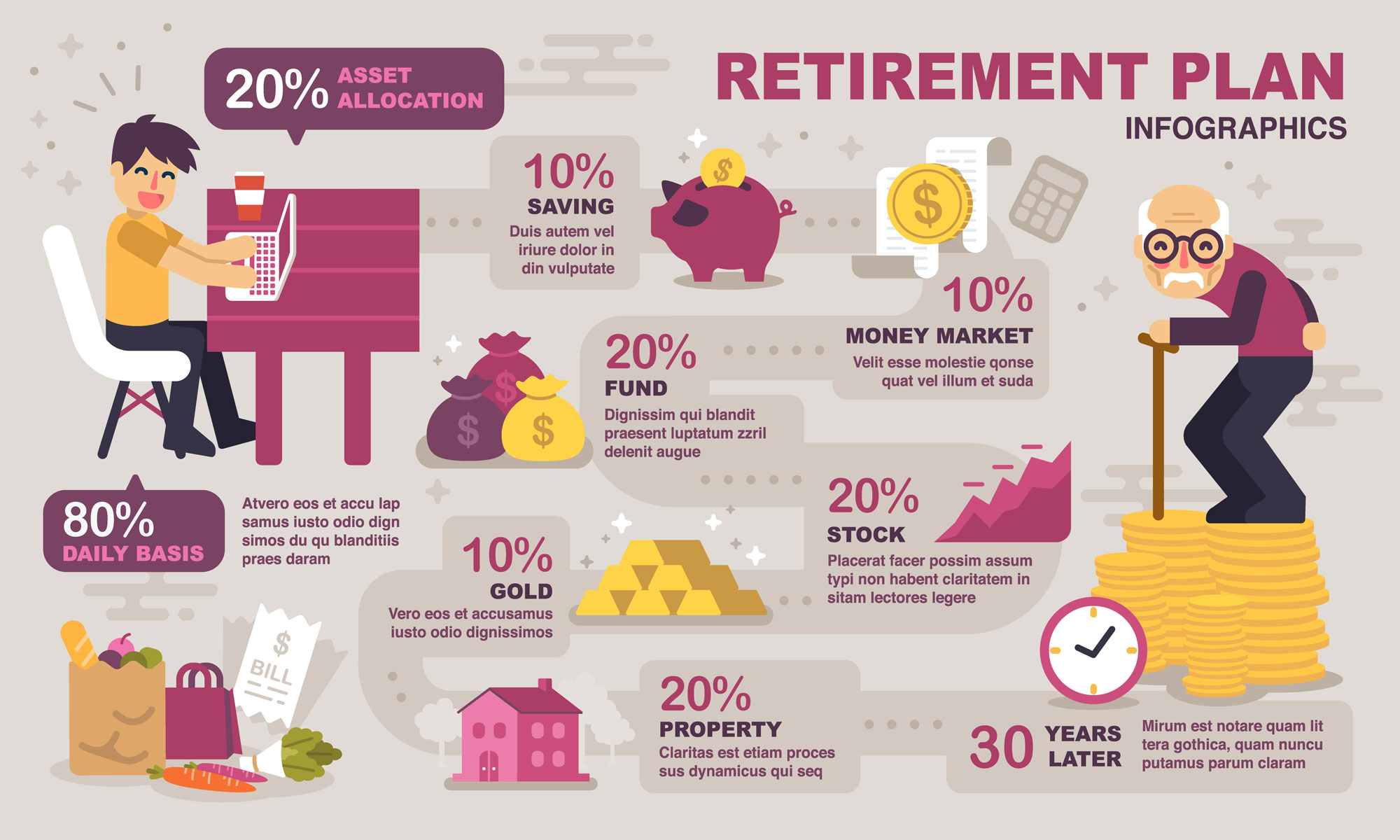

There are a number of retirement plans and pension plans that assist those who wish to make a saving for their future. IRA (Person Retirement Account) is a savings account that many individuals select to make their future secure. This is one safe and secure place where people deposit repaired money. Some deposit monthly, and some plans request a yearly payment. This money is purchased different profit making plans like Genuine estate, or mutual funds, stocks etc for including revenue further. Hence buy the time you retire, you likewise a great amount waiting you so that you are as abundant as you remained in your youth.

We have all heard the stating above sometimes in the past, but do you really understand what it indicates? If you resemble many people you probably believe about savings accounts, stocks, and other investment means. The reality is-- you can put some excellent early retirement planning concepts into action by simply re-evaluating your existing expenses. How much do you invest at the supermarket every month? Do actually require some of the items you acquire? Do an inventory of all your expenditures and see just how much you might conserve.

Time moves quickly: Before you understand it you are going to strike that point in your age when it is retirement education time to retire so waiting is just not an alternative any longer.

It is important to understand what your income will appear like at retirement age. What will your social security benefits appear like? At what age do you mean to retire? Will your home/auto/boat be paid for?

So download a calculator or more and experiment with some situations. In the procedure you may fulfill an advisor that can bring significant value to your strategies. Start with your present age and project a number of different retirement ages such as 60 years old and 70 years of age. The calculator will ask about your income now, how much income you wish to have at retirement and what you have actually saved presently. What you will get is a price quote of what you will need to save to get the income you desire. Today the real visionary work starts.

Research all the information that you can also. There are lots of articles and topics on this subject. You will wish to learn all that you can so that you are prepared to make all the last options for your retirement preparation. There is recommendations that you must take so that you are able to make the right choices and you will want to make certain that you do what you feel is going to be the best strategy for your requirements.